A tourist tax is a tax that a person staying in an accommodation such as a hotel, campsite, holiday lettings, bed and breakfast must pay to the accommodation provider.

The accommodation provider then declares the tourist tax to his municipality or canton and pays it to them.

In short, the accommodation provider collects the tourist tax on behalf of the commune or canton.

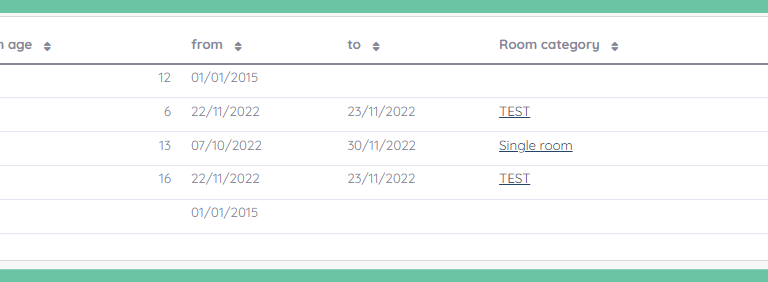

This tax is compulsory, but varies according to the canton and the customer, which can cause difficulties in calculating it. Fortunately, Arhon provides you with a real answer to facilitate their management.